Financial education, technology are crucial in the new normal—Home Credit and CIC

As a developing economy, it is no surprise that the Philippines still has a long way to go when it comes to financial literacy. Just before the government imposed the enhanced community quarantine (ECQ) amidst the COVID-19 pandemic, the Bangko Sentral ng Pilipinas (BSP) conducted its 2019 Financial Inclusion Survey (FIS), which revealed that Filipino adults could only answer 1 in 3 financial literacy questions correctly. Only a small number of respondents (8%) got all three questions correctly, while almost one-fourth (24%) obtained a zero score.

As many families struggle to cope with the economic effects of the pandemic, the need for financial education becomes more crucial than ever. And with this, is the increasing need for digital tools that would make accessing financial services faster, safer and more convenient.

Digital is the new normal

In a recent Virtual Media Forum organized by Home Credit, Sheila Paul, Home Credit Philippines’ Chief Marketing Officer, shared how technology plays a key role in serving its customers as well as enabling financial education and literacy. “Digital is the new normal—and financial institutions like Home Credit are fully and quickly embracing digital technologies to reach more people and cater to the public’s ever-changing needs,” said Ms. Paul.

The Prague-based company, now with 7 million customers and 2.2 million active monthly users of its mobile app in the Philippines, arrived in the country in 2013 to pioneer in-store financing of mobile phones and other gadgets and commodities, with minimal requirements and loan approval in as fast as one minute. It has since expanded its services from being mainly in malls to now being also heavily present online, with its My Home Credit app offering a slew of features and services.

“The pandemic has intensified the demand for online and mobile financial solutions, and we don’t see this slowing down anytime soon,” Ms. Paul said. “This is why on top of allowing our customers to get started on their Home Credit loan applications and check their account status right there in the app, we also developed safer, contactless payment options for our customers such as our QR-enabled credit card and online payment channels, and even our very own Marketplace where customers can shop for different commodities through our mobile platform.”

Credit score access goes digital

As more Filipinos turn to technology to help speed up their access to loans, there is also an increasing need to safely access their information—especially credit reports, credit scores and other information that can help financial institutions approve loan applications. That is where the Credit Information Corporation (CIC), a public credit registry, comes in, as it is responsible for gathering Filipinos’ comprehensive credit information—be it from loan payment histories or even records of credit facilities— and facilitating its access.

Prior to the pandemic, accessing one’s credit information from the CIC was quick and convenient, but also manual and paper-based, requiring consumers to be physically present at CIC premises for the know-your-customer purposes. But now, just like Home Credit, the CIC has undergone a digital transformation of its own.

At a fireside chat during the Virtual Media Forum, Atty. Aileen L. Amor-Bautista, the CIC’s OIC, President and CEO, talked about how CIC addressed this issue and enabled secure, remote access to individual credit reports and credit scores in the new normal. “Due to increased borrowing caused by COVID-19, we decided to digitize our services, where individual borrowers get to access their own credit information using their mobile devices through one of our accredited credit bureaus, CIBI with its CIBIApp,” said Atty. Amor-Bautista. “With this app, identity verification is done online to help secure the process, especially since travel is restricted and everyone is advised to do social distancing.”

Financial and digital education more crucial than ever

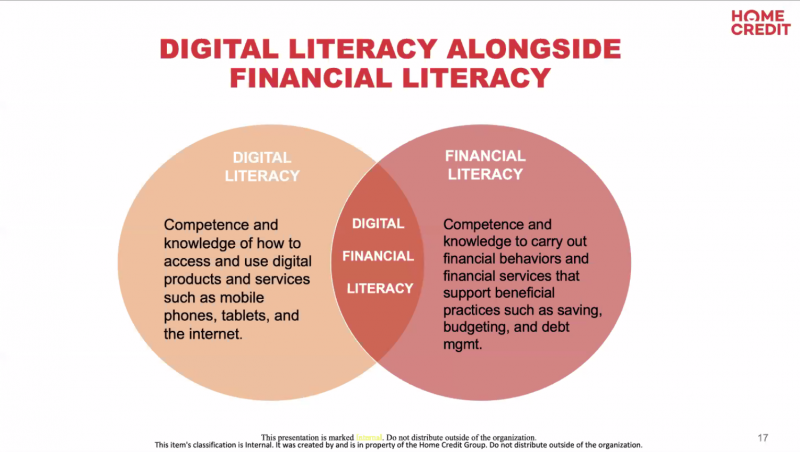

With Home Credit and CIC both leveraging on Filipinos’ increased use of mobile phones and the internet especially in the new normal, there remains big gaps in terms of how these same technologies are trusted by consumers especially for financial services. Thus, according to Ms. Paul and Atty. Bautista, education is more crucial than ever in order to build trust—and in this new normal, the education must be done digitally.

“With lockdowns and social distancing accelerating the use of digital services, we had to come up with creative, educational, and engaging financial literacy content to reach millions of people,” Ms. Paul added. “Whereas before, our flagship ‘Juan Two Three’ campaign would visit barangays across the country to teach financial literacy, we are now doing it digitally through social media, our website as well as our mobile app, and in the process we are teaching Filipinos how to use these new technologies. Which is why this next phase of our campaign is fittingly called “Digital na si Juan.”

Atty. Amor-Bautista also touched on CIC’s efforts in ensuring consumer rights protection and gauging creditworthiness amidst the pandemic. “We want Filipinos to know that despite the challenges of this pandemic, their credit information remains not only secure, but also more accessible than ever, which can help them get approved for loans and other financial tools,” she noted. “And with additional support measures such as the Bayanihan To Recover as One Act, we are also making sure that those that have good records who decide to avail of grace periods for loans will continue to have a positive record.”

Working together for financial inclusion

Since 2017, Home Credit and CIC have been conducting joint activities to promote the importance of good credit standing among borrowers, in what both institutions hope to be a long-term partnership in championing financial inclusion and literacy.

“From our financial literacy program to our digitized products and services, we hope to continue remaining sustainable in serving more Filipinos,” said Ms. Paul. “Home Credit upholds its commitment to support BSP and CIC in promoting financial inclusion through education and technology, especially in this new normal.”